Pip (singular)/ pips (plural) is a basic concept in Forex. It represents the smallest incremental move an exchange rate can make.

It is a “point” for calculating profits and losses. In the Forex market the exchange rate rises and falls by pips. Depending on the context, it is normally one basis point.

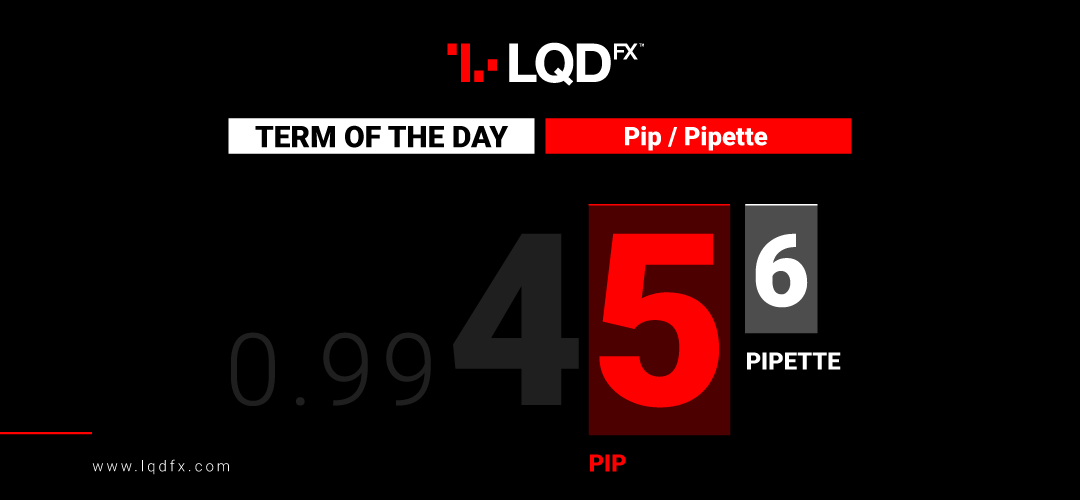

Since most major currency pairs are priced to four decimal places, the smallest change is that of the last decimal point: 0.001 in the case of EURUSD, GBDUSD, USDCHF.

In other words, if EURUSD rate is 1,5220 then the number of the pip is 0. If the exchange was previously 1.5220 and now it rose by one pip, then the exchange rate will be 1.5221.

The case of the Japanese Yen is different. For the Japanese Yen we denote pip at two places after the decimal point, thus .01. Therefore, in all pairs involving the Japanese Yen (JPY), a pip is the 1/100th place. For example, if USDJPY is at 88.57 then pip is equal to 7. If the exchange rate rises by 3 pips it would be equal to 88.60.

Pip stands for Percentage In Point. You can find more about this Forex term in our Courses, Beginners Course, Basic Forex Terms.

What pipette has to do with Forex? Is there any chemistry involved?

Actually, Forex does not involve chemistry, apart from the good chemistry between the trader and the broker, which is essential for a successful Forex trading strategy.

Pipette is one-tenth of a pip or a point/unit. Usually, a pip is the smallest value (0.00001 in the case of EURUSD, GBDUSD, USDCHF and .001 in the case of USDJPY).

Since brokers started to use 5-digit quotes more and more, traders often confuse the two terms. In this case, pip is the 4th decimal in a quote while the pipette is the 5th.

Sources: Investopedia, Investowords

PLEASE NOTE The information above is not investment advice.